Grow your business, not your debt.

Payvus® makes it possible.

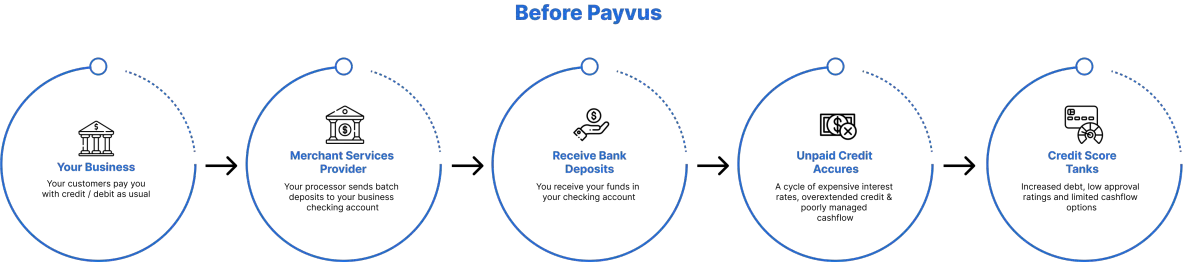

65%-70% of businesses that apply for new credit through their bank were denied pre Covid - now it is even worse. Cash advance style lending and term loans are expensive, while using personal credit cards for business expenses can damage your personal FICO score.

Grow your business, not your debt.

Payvus® makes it possible.

65%-70% of businesses that apply for new credit through their bank were denied pre Covid - now it is even worse. Cash advance style lending and term loans are expensive, while using personal credit cards for business expenses can damage your personal FICO score.

Why Choose Us

Why Choose Us

A better way to fund your business and do more with your money.

Payvus is an innovative cash flow optimization tool and business line of credit product which will unlock

much needed business capital for 99% of those that apply, help you avoid paying interest, establish

strong business credit history going forward, and improve your personal FICO score.

99% Applicant Approval Rate

Up to $10,000 to start with periodic credit line increase reviews

95% of users avoid paying any interest fees

Avoid using personal credit for business purposes & improve FICO score

Stop relying on expensive personal credit cards, cash advances and term loans that are difficult to qualify for

Improve business credit profile and ensure fiscal health through

uncertain economic times

Payvus is more than just a card

Enjoy all the credit card benefits, without the credit card pitfalls

Payvus User Case Studies:

Plumbing / HVAC Company

$4 million annually in credit card processing 30% going to the

Payvus card

Background:

After doubling his business’s revenue, he was seeking additional

ways to improve the way he ran his business.

He wanted to separate his personal and business finances.

Results: within 12 months of using Payvus

Paid off 2 personal credit cards that they had been using for

business expenses.

Avoided paying any interest on credit purchases made with

the Payvus card

Payvus increased his credit limit five-fold.

Total Annual Cost Avoidance: $33,800

Interior Design Firm

$480K annually in credit card processing 20% going to the Payvus card

Background:

Results: within 9 months of using Payvus

After partnering with another designer, she was looking for a business card that offered availability to issue cards to employees

She also wanted to separate and simplify her personal credit from business

Tracks employee spending through the portal.

Has been able to increase her limit and personal FICO score,

while avoiding paying interest on her Payvus card.

Total Annual Cost Avoidance: $9,120

Dry Cleaner

$100K annually in credit card processing 30% going to the Payvus card

Background:

Years of overextending personal credit made qualifying for a traditional business card impossible

He wanted to expand his business, but needed to find a cost efficient line of credit to help cover day-to-day business expenses

Results: within 12 months of using Payvus

Increased and sustained his usage of the card while increasing

the amount he settled to the account on a daily basis

Credit purchases are paid before they are billed or accrue

interest keeping account in good standing

Payvus tripled his credit limit in less than one year

Total Annual Cost Avoidance: $1,900

What People Say About Us

“My bank denied me business credit due to being in business less than 6 months and not having pre-existing business credit. I refused to use those predatory cash advance loans, and did not want to use personal credit cards and risk damaging my personal credit. I was approved for the Payvus Visa Business card after only two weeks in business - when I needed the cash flow most.”

ADAM SEYMOUR

“Before I found Payvus I was revolving large balances on personal credit cards and paying more than 19% interest on those balances. With Payvus payments are automatically made from my merchant services deposits allowing me to stop using personal credit, stop revolving a balance and ultimately avoid paying any interest on business purchases.”

LAURA VULLO

“I had big plans to expand my business into new markets which would require a significant capital infusion. My business credit profile was damaged during the Covid pandemic creating a challenge getting approved for a traditional loan. After using the Payvus card for 6-9 months, with that activity reported to Dun & Bradstreet, my business credit profile was catapulted into nearly perfect status putting my business in the position to get approved for the funds I needed in order to expand.”

SUSAN TUFFIELD

“Within 12 months of using the card, I paid off two personal credit cards that I had been using to pay for business expenses, and I avoided paying any interest on the credit purchases I made for my business with the Payvus card.”

STEPHEN ADDARIO

FAQ

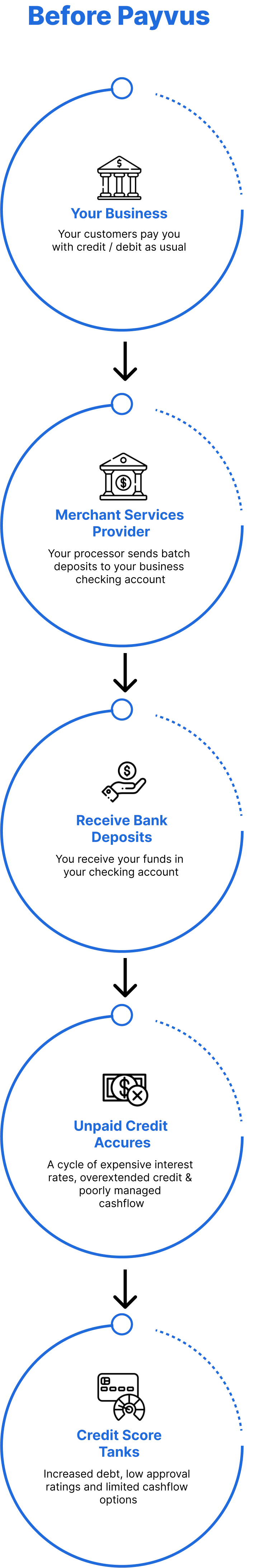

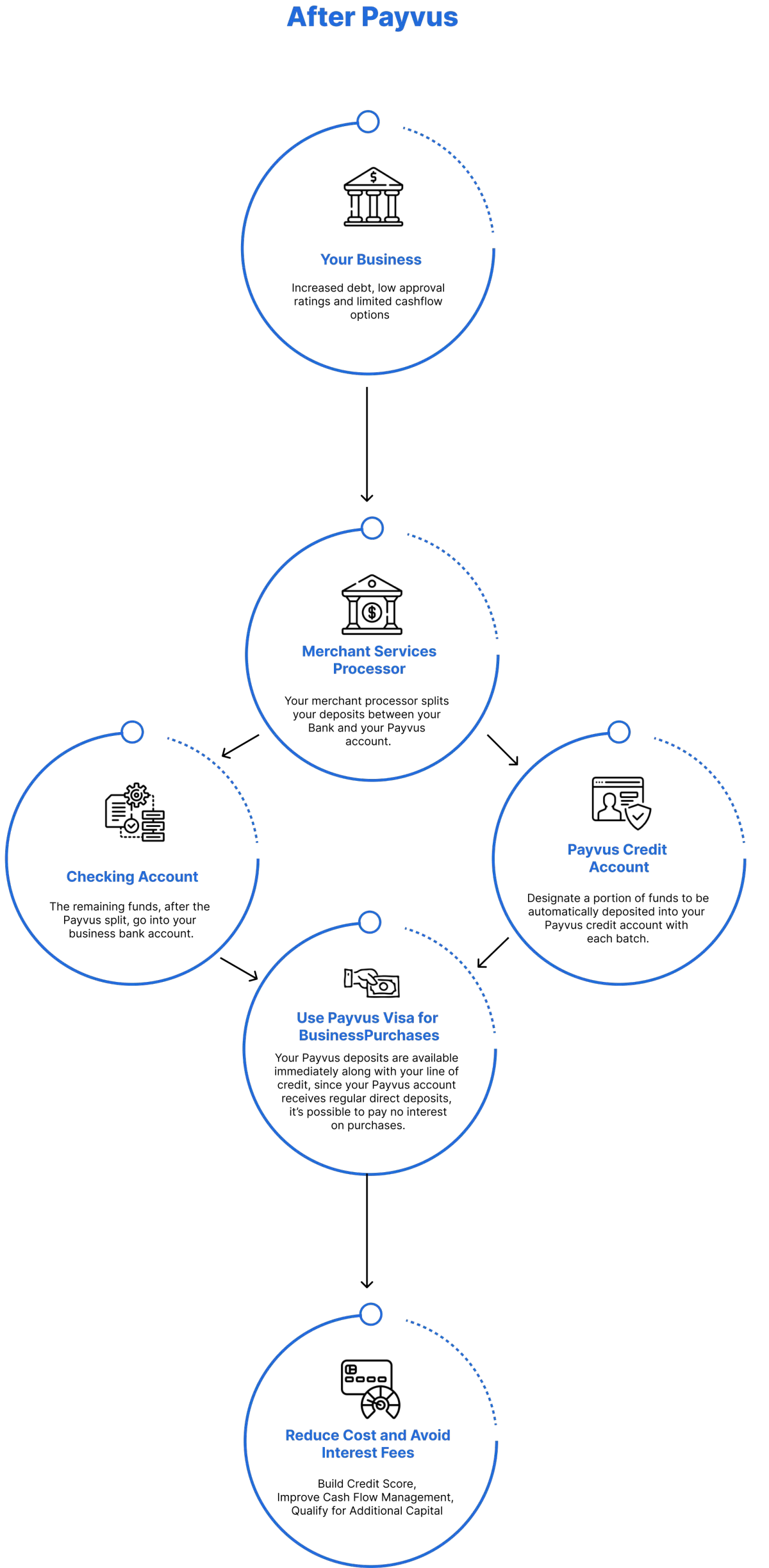

What is Payvus and how does it work?

Payvus is a Visa Business credit card account that is integrated with a business’s merchant services account. The business designates a percentage of each merchant services batch deposit to be split and applied as a payment towards the Payvus card. With Payvus, business owners get immediate access to their merchant services settlement funds - along with up to a $10,000 line of credit - to spend on everything a merchant needs to effectively run and grow their business without creating more debt. With automatic deposits & payments to the Payvus account there’s no monthly bill to worry about and it is possible to avoid paying any interest fees on your purchases.

Am I required to change my merchant services processor?

No. Payvus is processor agnostic. Your Payvus specialist will work with you and your processor to get your accounts connected.

In order to qualify is there a minimum amount of time in business required?

No. It is because of the interface with your business’ merchant services account that 99% of applicants are approved for up to $10,000 regardless of the length of time you have been in business.

Will applying for Payvus affect my credit?

No. A “soft pull” is used to obtain your FICO score which will not impact your score.

How much credit will I qualify for?

The amount of credit - up to $10,000 - is determined when the application process is complete. Periodic credit line increase reviews will be performed after 90 days of use.

What is the APR for unpaid credit purchases made with the card?

15.49% + prime, and never below 18.99%, which is comparable to other small business credit cards. However, 95% of Payvus cardholders avoid paying interest on credit purchases because payments of their settlement funds are made to their Payvus account on a daily basis.

Can I get Payvus cards for my employees?

Yes. In the portal you can add employee cards and you can manage allocation of funds between your card and the employee cards.

Can I transfer funds from my card to my business checking account?

Yes. There is a 3% fee to transfer.

Where can I use this card?

You can use Payvus everywhere Visa is accepted.

APPLY FOR YOUR PAYVUS CARD TODAY!

Get the tools you need to take control of your business funding and do more with your money

© Aligned Business Solutions

© Aligned Business Solutions